REAL ESTATE

Cause for Optimism?

The Housing Market

While the real estate crisis is far from over — the poor economy and disastrous unemployment rate remain potent causative factors — there is some reason for optimism. However, in these treacherous financial circumstances, whether you are a seller or buyer, your best bet is to work with a professional, especially if you are considering a short sale, writes real estate expert Ashok Gupta.

The real estate market is local and not global as most people perceive. No matter how stable the market is, it is always changing. We have seen a jump in home sales during April 2010 and are looking at a slowdown as the tax credit is over as of April 30, and more so for the unemployment numbers. I see opportunities in every scenario — either buying or selling properties.

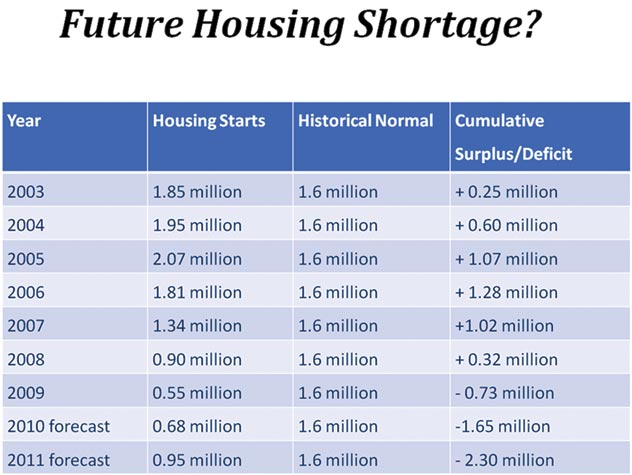

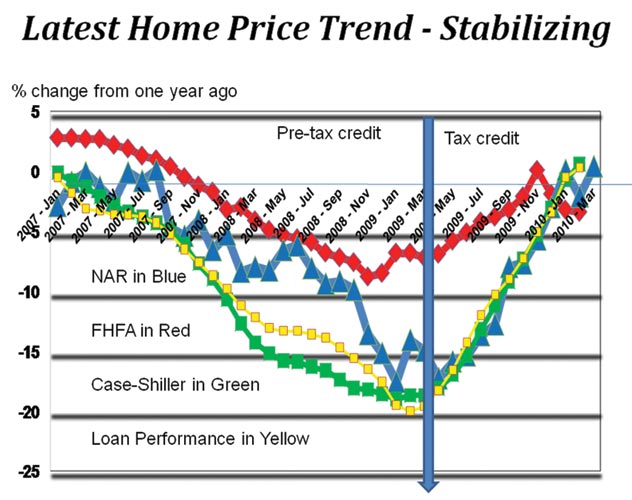

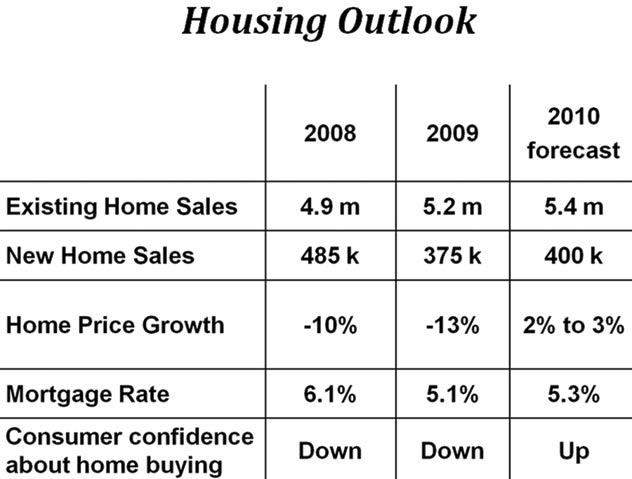

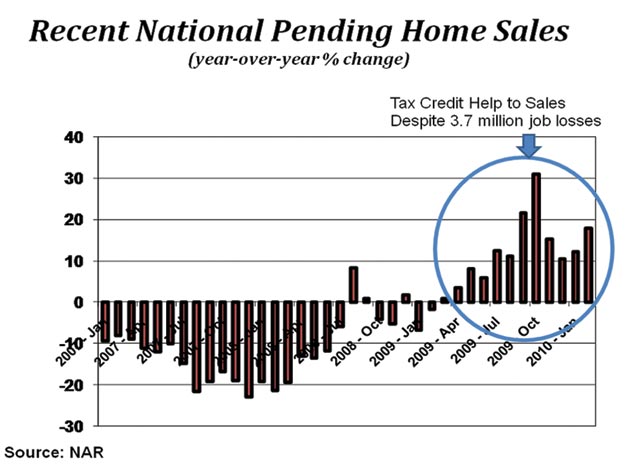

Let us study the numbers. Tax credits definitely stimulated the housing market, despite 3.7 million job losses from July 09 to April 2010. But what we tend to forget is that out of 4.4 million home buyers that received or will receive the federal home buyer’s tax credit, 2/3 of the tax credit went to first-time buyers and 1/3 to repeat buyers. According to the National Association of Realtors, 1 million out of the 4.4 million entered the housing market due to the tax credit incentives. Around 3.4 million buyers would have purchased a home anyway even if no home buyer’s tax credit had been offered. Lower prices and low interest rates were actually a bigger factor for most sales and will continue to be so.

Most of the country still has a surplus of inventory. The San Francisco Bay area market obviously has a much lower percentage of standing inventory, which has caused prices to stabilize in most of Northern California. Along with the Bay Area, seven other major real estate markets have experienced a price increase year over year. The number of homes sold across the country has increased 16 percent year over year (2009 vs 2010). (Source: http://www.realtors.org/). Consumer confidence has been on an upward trend since January 2009. These are all signs of a healthy and vibrant real estate market in the Bay Area.

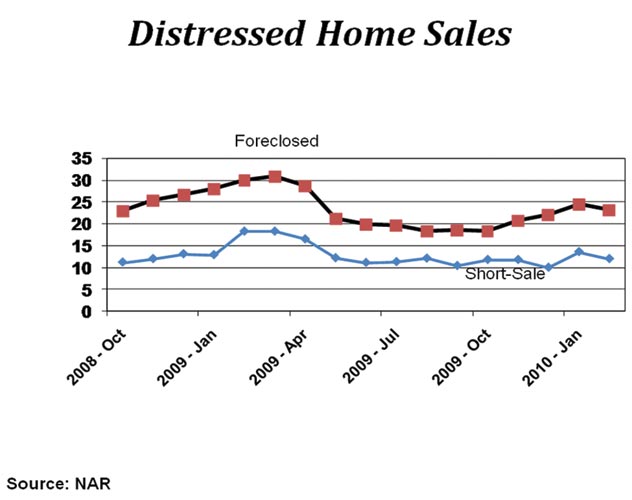

On the other hand we have seen that of all mortgages one out of six mortgages are under water as evident from the table. (See ‘Mortgages in trouble’ table). This gives a new perspective to look at when buying and selling properties.

While reviewing the above information, the Distressed Property Institute estimates that the total number of distressed properties in the country is a at 6,700,000 and NAR estimates total predicted sales at 6,030,000. (Source: NAR, Walt Molony, http://www.realtor.org/press_room/news_releases/3010/02/metro_state).

This is depressing, yet there is good news. The banks are working with qualified distressed property experts and are helping home owners avoid foreclosure. These experts are commonly known as CDPEs. It goes without saying that as a homeowner in distress, you should always avoid two things, a foreclosure and bankruptcy, for obvious reasons. Considering a mortgage modification or a short sale is the most common option available. I have seen people jumping in to mortgage modification and short sale process all by themselves. Yes, you can do it. However, it is important you understand the complete process.

I would like to discuss some common mistakes agents and homeowners make when handling a short sale.

A most common mistake is that they price the property either too high or too low. Discussing a complete listing price strategy with a professional, based on the current market condition and the time you have to sell, is critical.

Secondly, every lender uses different sets of forms to deal with a short sale. A wrong set of forms or information layout causes the rejection or delay of short sales proposals. Inadequate follow-up may result in jeopardizing the transaction. Proper communication with everyone involved will avoid unnecessary delays, and hence foreclosure.

Foreclosure laws are area specific. An estimated timeline for the process, from start to closing and knowing how to communicate with your lender is critical. Certain information can be provided to lenders to postpone your foreclosure for weeks or months in order to negotiate a sale. Not following the directions from the lender and expecting an over-worked, under-staffed department to go out of their way to handle your file can be very disappointing. There is very little likelihood of this situation working out in your favor.

An offer presented to the lender should be realistic, strong and the buyer pre-approved for financing. The buyer’s verification of closing funds and ability to buy needs to be confirmed.

I have seen offers having little chance of closing – either they are too high or too low. If the offer is too high – it will not pass the appraisal test; and, if it is too low – the lender will not accept it. Risking this process with an uneducated agent who does not appreciate this aspect of short sales may be disastrous.

The bottom line. All properties sell if there is a right price and all buyers buy if they get good value for their money. The market is always good; the only factor is how you are looking at it. If you are a seller moving to a different home and you think you are selling at a lower price, you are so certain that you shall be buying your new home for a lower price too, and vice-versa.

|