|

|

|

ADVERTISEMENTS

|

|

PREMIUM

- HAPPY HOLIDAYS!

- Siliconeer Mobile App - Download Now

- Siliconeer - Multimedia Magazine - email-Subscription

- Avex Funding: Home Loans

- Comcast Xfinity Triple Play Voice - Internet - TV

- AKSHAY PATRA - Bay Area Event - Sat. Dec 6

- Calcoast Mortgage - Home Loans

- New Homes in Silicon Valley: City Ventures - Loden Place - Morgan Hill

- Bombay to Goa Restaurant, Sunnyvale

- Buying, Sellling Real Estate in Fremont, SF Bay Area, CA - Happy Living 4U - Realtor Ashok K. Gupta & Vijay Shah

- Sunnyvale Hindu Temple: December Events

- ARYA Global Cuisine, Cupertino - New Year's Eve Party - Belly Dancing and more

- Bhindi Jewellers - ROLEX

- Dadi Pariwar USA Foundation - Chappan Bhog - Sunnyvale Temple - Nov 16, 2014 - 1 PM

- India Chaat Cuisine, Sunnyvale

- Matrix Insurance Agency: Obamacare - New Healthcare Insurance Policies, Visitors Insurance and more

- New India Bazar: Groceries: Special Sale

- The Chugh Firm - Attorneys and CPAs

- California Temple Schedules

- Christ Church of India - Mela - Bharath to the Bay

- Taste of India - Fremont

- MILAN Indian Cuisine & Milan Sweet Center, Milpitas

- Shiva's Restaurant, Mountain View

- Indian Holiday Options: Vacation in India

- Sakoon Restaurant, Mountain View

- Bombay Garden Restaurants, SF Bay Area

- Law Offices of Mahesh Bajoria - Labor Law

- Sri Venkatesh Bhavan - Pleasanton - South Indian Food

- Alam Accountancy Corporation - Business & Tax Services

- Chaat Paradise, Mountain View & Fremont

- Chaat House, Fremont & Sunnyvale

- Balaji Temple - December Events

- God's Love

- Kids Castle, Newark Fremont: NEW COUPONS

- Pani Puri Company, Santa Clara

- Pandit Parashar (Astrologer)

- Acharya Krishna Kumar Pandey

- Astrologer Mahendra Swamy

- Raj Palace, San Jose: Six Dollars - 10 Samosas

CLASSIFIEDS

MULTIMEDIA VIDEO

|

|

|

|

|

REAL ESTATE:

Rays of Sunshine?

The Housing Market

Things are looking up in the real estate market, despite the confusing news in the media, writes real estate expert Ashok K. Gupta.

Home sales hit bottom in 2007 and up in 2008 and 2009. We are always bombarded with confusing and contradicting reports in the media. A headline in the front page of the San Jose Mercury News may say, “Home sales continue to slide,” and an inside story could say “The median price for resale houses in Santa Clara County rose to $575,000 in September, up 13.5 percent from a year ago…”

The good news is that people have started buying homes again. This is helping the real estate industry to grow, which has been passing through the worst sales year in more than a decade.

Pending home sales rose in November also, making it the fourth increase in five months. First quarter of 2011 is going to get a boost because there’s usually a one- to two-month lag between a sales contract and a completed deal, and with REO properties and short sales, it may take anywhere between 90-120 days. A report on sales show that signings jumped 18.2 percent in the West, 1.8 percent in the Northeast, while the Midwest region saw a 4.2 percent drop, and the South posted a 1.8-percent dip.

(Above): The prices are falling in some areas, however, the buyers are facing competitive market with multiple offers on more than half the transactions, be it REO, Short Sale, or regular Equity Sale properties. This multiple offer situation has been on the rise ever since the market started crashing in 2007.

The prices are falling in some areas; however, and buyers are facing competitive market with multiple offers on more than half the transactions, be it REO, short sale, or regular equity sale properties. This multiple offer situation had been on the rise ever since the market started crashing in 2007.

The economy is expected to add more jobs resulting in the real estate market growing gradually. This will give a good boost to sales. As a word of caution, this may not affect the average net sales proceeds to the seller, as most people are buying foreclosed homes and that is driving prices down. This drop in home prices in next 6-12 months may average around another 5-10 percent of today’s price.

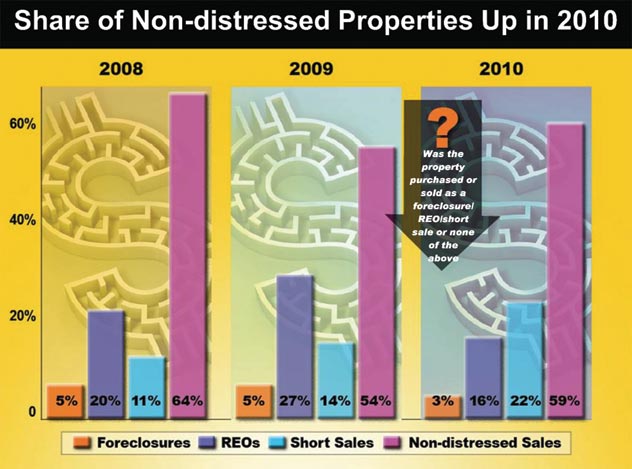

On the other hand, the share of non-distressed properties sale has increased significantly in 2010 compared to last year. While the distressed properties’ share for REO’s is declining, the share of short sale transactions has grown in 2010.

(Above): The share of non-distressed properties sale has increased significantly in 2010 as compared to last year. While the distressed properties share for REO’s is declining, the share of Short Sale transactions has grown in 2010.

Distressed home sales are driving home prices down and may go for almost 50 percent discount, and a third of pending sales likely will be foreclosures or short sales in the coming year.

The relief to this situation can be seen in the loan modification applications that are currently being seriously reviewed by lenders as against the short sale or foreclosure. In most of the cases lenders are offering a trial modification program to the borrowers. This is helping borrowers getting a postponement on the foreclosure or trustee sale and is indeed a sigh of relief for homeowners. This is helping lenders also as they avoid an expensive foreclosure or trustee sale process. This relief is available to homeowners who had been facing financial hardship but expect their situation to improve due to the changing job situation and an improvement in their financial situation.

The mortgage rate is another challenge in arresting falling home prices. Potential buyers are not able to qualify because of their fluid job situation and tight lending standards. The rising mortgage rate is not helping in arresting the falling home sales and prices.

All charts courtesy: California Association of Realtors (CAR)

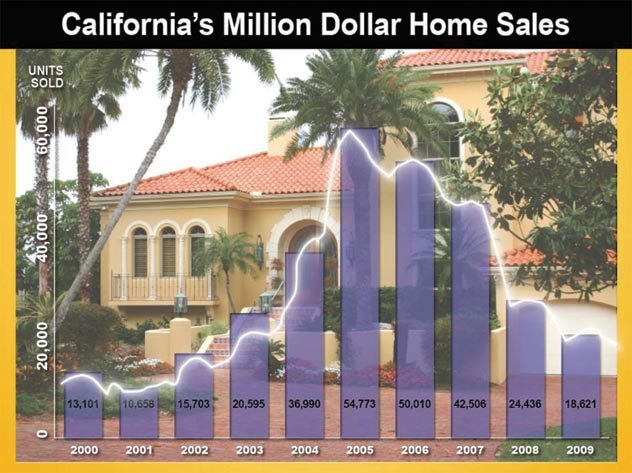

Home sales are said to be historically low, according to most media reports. The California Association of Realtors has reported the sales of existing homes since 1970. The market got the most serious hit in the 1978-82 period when there was a 61 percent decline in home sales as against the 2005-08 periods when the drop was only 41 percent. Home sales have seen a comeback in 2009 and 2010 was close to 2006 numbers. Home prices are seeing a comeback in 2010 after a serious dip in 2009.

The number of home sales in Bay Area counties is not too different now from the previous year. Prices in most of the Bay Area counties are down on a month-to-month basis, and are on the rise significantly on a year-to-year basis, especially in San Mateo, Santa Clara and Alameda counties. The notices of default issued in the second quarter of 2009 was 19,983 compared to 12,231 in the second quarter of 2010. This is a significant shift that is pointing towards an improvement in foreclosure prevention, either by way of short sales or mortgage modification.

|

Ashok Gupta, CDPE, ePRO is a broker-associate at Intero Real Estate office in Fremont, Calif. He is a Certified Distress Property Expert and has earned designation of ePRO recognized by National Associaition of Realtors. He can be reached by email at ashok@happyliving4u.com. Web: www.happyliving4u.com | www.interoshortsale.com | Tel: (510) 604-6414. Ashok Gupta, CDPE, ePRO is a broker-associate at Intero Real Estate office in Fremont, Calif. He is a Certified Distress Property Expert and has earned designation of ePRO recognized by National Associaition of Realtors. He can be reached by email at ashok@happyliving4u.com. Web: www.happyliving4u.com | www.interoshortsale.com | Tel: (510) 604-6414.

|

|

|

|

|

|