MARKET WATCH:

Real Investing: Real Estate Trends

Not too long ago we all have faced a financial situation in the country reminding us of the Great Depression of 1930s. Workers being laid off, no new jobs, economy out of control, GDP at its lowest level, housing prices unbelievably low, and, giving an impression of never returning to normal. Auto and housing industry was one of the worst hit sectors. Today when we look at the revival of the housing market, it may not be the same in all places, however, major metros have seen a definite comeback and are heading towards the prices we have seen in 2006, writes Ashok K. Gupta.

Surprisingly, interest rates and housing prices, both are on the rise. The average 30 year fixed rate jumped more than 100 basis points from 3.35 percent in early May to 4.46 percent in late June, as it reached its highest level since July 2011. The recent market data provided by PropertyRadar.com gives a promising and positive scenario for the housing market.

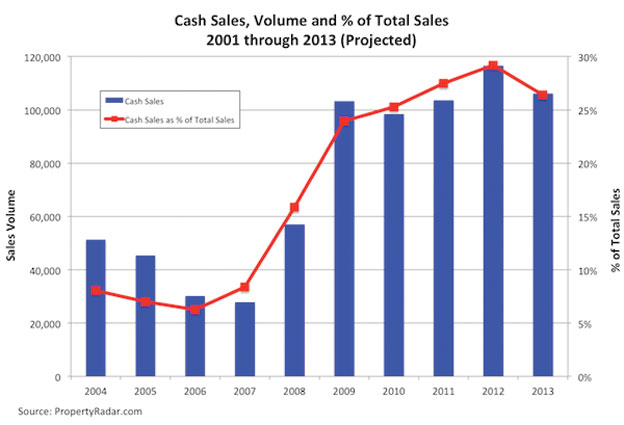

Cash Sales has been one of the high relative to pre-bubble period. The graph below illustrates the important role played by cash offers in real estate marketplace. Of all sales, cash sales peaked to 33.8 percent in February 2013.

In May and June this year, cash sales were 26.9 percent and 26.4 percent respectively of all sales, which was remarkably high and a major factor contributing to the steady marketplace.

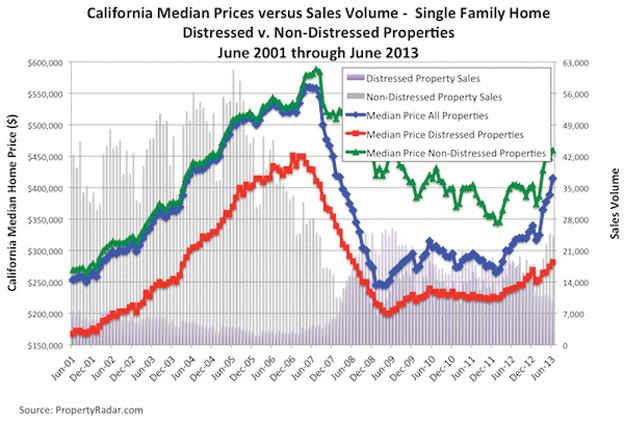

On the other hand, a low inventory and a negative equity in the houses is pulling and retreating prices back and forth. About 24 percent of homeowners have a mortgage more than their home is worth today. The rise in home prices is certainly helping homeowners, and about 500,000 homeowners will exit their negative equity if there is a 10% rise in the market price.

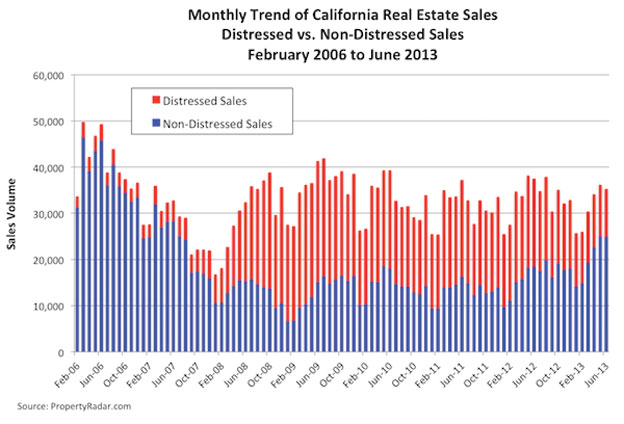

The good news is that median prices are increasing for distressed properties, non-distressed properties, and all properties, so is the volume of sale is increasing for the non-distressed properties and the sales volume trend is falling for distressed properties. There was a significant jump in prices between December 2012 and June 2013.

The challenge faced by Californians is that inventory is significantly low owing to the fact that a large number of California homeowners, about 6.9 million as of June 2013, owe significantly more than their homes are worth. This is effecting the market in two ways – one, the underwater homeowners cannot sell their existing home without impacting their credit, and two, if they do that, they may not be able to buy another home. This segment is completely out of market and may not hold the market scenario after buying season ends in September.

On the other hand, U.S. consumer sentiments rose in July to the highest level in six years as Americans felt better about the current economic climate though they expected to see a slower rate of growth in the year ahead.

The Housing affordability index for first-time home buyers was the highest in Marin County followed by San Mateo, San Francisco and Santa Clara counties, based on an entry level home price.

The buyers have more “skin in the game.” 54.4% buyers put 20%+ down payment, compared to 43.2% in 2006. The zero % down payment buyers have reduced to 4.6% in 2012 from 21.1% in 2006, and cash buyers have increased from 11% in 2006 to 30% in 2012 and more in 2013. The likelihood of default is also reduced because of more “skin in the game.”

As the economy continues to improve slowly but steadily, housing market conditions will remain healthy in 2013. Sales will be strong during the year as housing affordability hovers at record levels.

The statewide median price is expected to increase modestly in 2013, with change in the mix of sales due to more homes being sold in high-end markets and a shortage of inventory, putting an upward pressure on home prices. Fierce market competition, however, will continue to be the norm in 2013, as tight supply condition remains an issue, especially for areas with a significant share of REO sales.

The housing industry in California is in recovery mode. Multiple offers and bidding wars are now a norm in many markets. For buyers, only the “most fit will survive,” and succeed in purchasing a home — those with excellent credit and a sizeable down payment could still compete with investors paying all cash.

It is a great sellers’ market currently as bidding for good housing is driving prices high with better terms like all cash, no loan contingency, no appraisal contingency, no inspection contingency, as-is condition, and so on.

A recent buyer survey by the California Association of Realtors revealed the following facts:

• Buyer optimism about future direction of home prices is growing; with the majority of buyers (60 percent) believing prices will go up in five years and 36 percent believing prices will rise in one year.

• Higher down payments are the norm for the market these days, with buyers putting an average of 25 percent down on their home purchase. The average down payment has been higher than the traditional 20 percent since 2009.

In any event, the housing market future looks good. Homeowners who sold their homes in short sale, under distress, foreclosed their homes, or moved out of their homes in any other condition, have caused the rental market to shoot upwards as these homeowners may not buy homes for the next 3-5 years because of their credit. Investors are taking advantage of this unique situation to their best.

We have seen that an average Indian worker sends money to their homeland for supporting family, whereas, other oriental Asians are bringing money in the country to invest in real estate.

The low inventory, all cash offers, no contingencies, buyer biddings on limited number of homes on sale, is going to continue as long as investors are in the market as the rental market is increasing as well.

|